- Salary slip format in excel how to#

- Salary slip format in excel full#

- Salary slip format in excel software#

- Salary slip format in excel download#

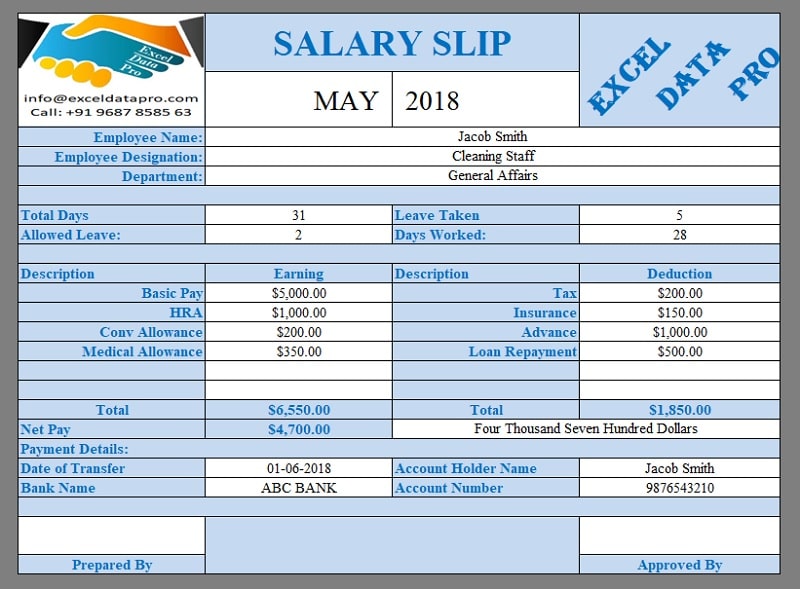

If the employee salary is above 15000 Rs, still the employee and employer can contribute to the EPF scheme based on their mutual interest.įor employers, they must have minimum 10 or above employees to register their establishment under EPFO scheme 1952.Įvery employee whose monthly gross salary is below 21000 Rs will be eligible for ESIC scheme.įor employers they must have 10 or above 10 employees to register their establishment under ESIC scheme 1948. So overall 4% of employee gross salary will be paid towards ESIC account in every month.Įvery employee whose monthly basic wage + Dearness Allowances (DA) is below 15000 Rs will become eligible for the EPF scheme. For future legal considerations, this slip can be used against an employer. The organization used it to determine the designation of an employee. ESI Calculation Formula Percentages 2021 ESI calculated on The salary slip format in excel enables assists the organization to manage the financial record of each employee. Note: If there is no DA then only basic wage is considered to calculate the EPF monthly contributions. So total employee will contribute 12% of basic wage + DA for PF and employer will pay 13% towards employee PF and pension accounts together. PF Calculation Formula Percentages 2021 PF calculated on You can enter hours/Amount,Overtime Pay and Bonus of Each Employee and Rest calculations will be done automatically which saves your times and no issues with calculations. Not only employees even employers can also use the above format to calculate the monthly contributions of employees towards PF and ESI. PaySlip Template comes with amazing format including Company Logo,Company Name,Employee details etc. The above excel format is updated as per the latest EPF and ESIC calculation formulas.

Salary slip format in excel download#

Salary slip format in excel how to#

This sheet will allowed to planning your tax saving, make salary structure as per your choice and know the Net in hand Automatically.

Salary slip format in excel full#

Salary slip format in excel software#

Best part of this software is that, you can generate your salary pay slip from CTC in one click and change payslip in excel as per needs.This sheet will give you Net payment Automatically as per your change.You can add reimbursement components as per bills planing to get more benefit in tax.You can Se-off loss / income from house property u/s 24(b) as per Income Tax Act.

You can calculate Cost to company CTC Automatic once you put total ctc.This Excel Software have includes most likely all part of Payroll Calculation. Click here to download automatic Complete Payroll Calculator in Excel.

0 kommentar(er)

0 kommentar(er)